Traditional venture capital firms are no longer the only avenue for funding. Family office investing has emerged as a powerful alternative, offering not just capital but also long-term support and valuable networks.

As a startup founder, understanding how to engage with family offices could accelerate your company’s growth.

But what exactly are family offices, and how can they benefit your startup? Unlike institutional investors, family offices operate with greater flexibility and often invest with a long-term horizon.

To delve deeper into their operations, check out our guide on What Are Family Offices.

This comprehensive guide will arm you with strategies to secure funding from family offices. We’ll uncover their motivations, share techniques to personalize your pitch, navigate cultural nuances, and present success stories.

By the end, you’ll be ready to tap into this exclusive capital source for your startup.

What Drives Family Offices to Invest in Startups

Family offices are increasingly investing in startups for several compelling reasons:

- Legacy Building: Preserving and enhancing family wealth across generations remains a core objective. Investing in innovative startups allows families to create a lasting legacy and stay relevant in a rapidly changing world. For instance, a family with a history in manufacturing might invest in cutting-edge technology startups to drive advancements in their traditional industry.

- Diversification: Startups offer unique opportunities to diversify investment portfolios. By venturing into new sectors and emerging technologies, family offices can spread risk and capitalize on high-growth potential, protecting the family’s wealth against market volatility.

- Impact Investing: Many family offices are driven by a desire to contribute positively to society. Impact investing enables them to support startups that address environmental and social challenges, aligning investments with personal values. For example, investing in renewable energy startups contributes to sustainability efforts.

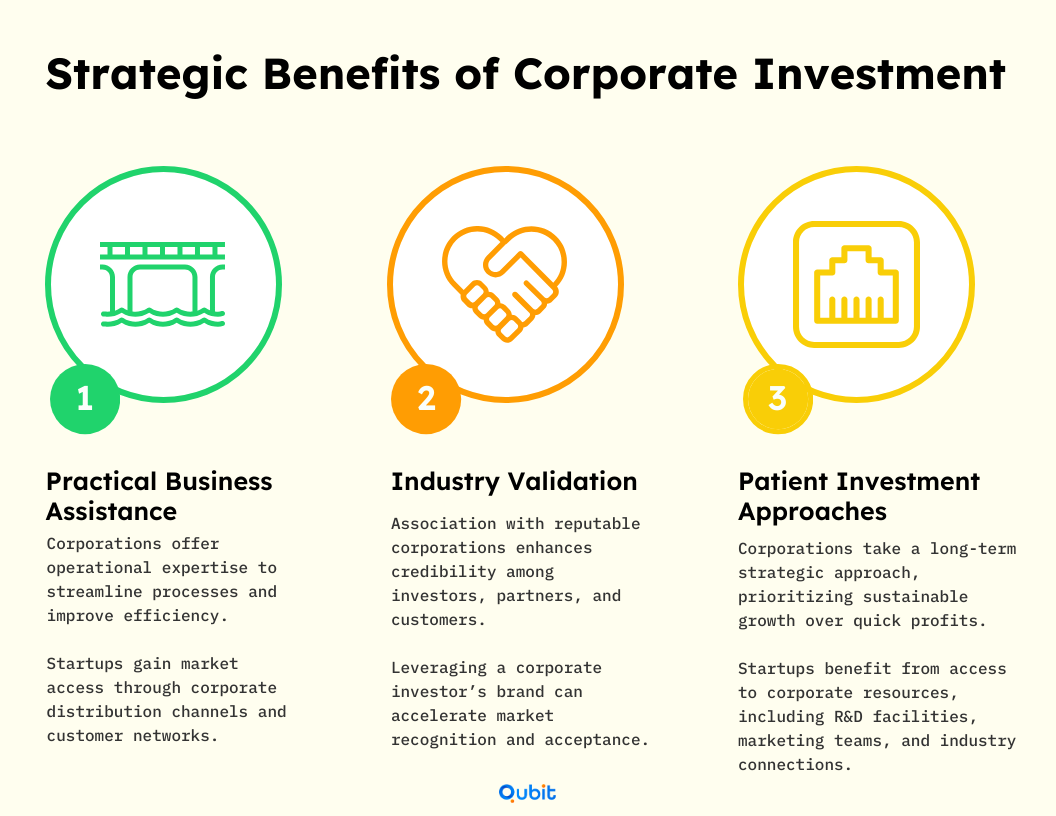

The Benefits of Partnering with Family Offices

Collaborating with family offices brings several advantages:

- Long-Term Perspective: Family offices often adopt a patient approach, focusing on sustainable growth rather than quick returns. This long-term outlook provides stability as your startup evolves.

- Flexible Capital: Unlike traditional investors bound by rigid mandates, family offices can offer customizable investment structures. This flexibility allows for tailored financial solutions that meet your startup’s unique needs.

- Strategic Partnerships: Family offices bring more than just capital. With extensive networks and industry expertise, they can open doors to new opportunities and provide valuable guidance instrumental in scaling your business.

The Generational Shift: Younger Influences

A significant trend influencing family office investments is the impact of younger generations within the family.

Tech-savvy millennials and Gen Z members are increasingly involved in decision-making, bringing fresh perspectives to the table. They often advocate for investments in innovative sectors such as technology, sustainability, and social entrepreneurship.

- Example: A family office traditionally focused on real estate might diversify into proptech startups due to the younger generation’s interest in technology and innovation.

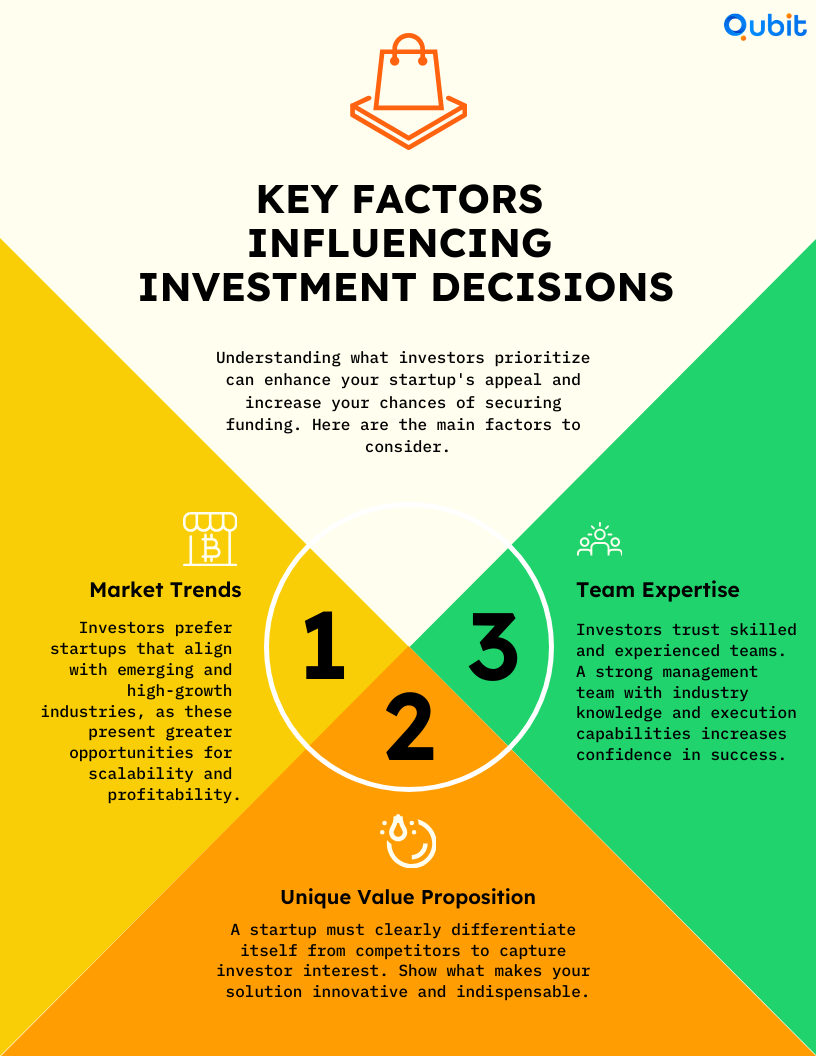

Getting into Investor Psychology

To effectively engage family offices, first try understanding the psychology behind their investment decisions:

- Emotional Motivations: Investments may be influenced by personal passions or family values. Aligning your startup’s mission with these can make your proposal more compelling.

- Desire for Involvement: Family offices may prefer a hands-on approach, seeking active participation in the startups they invest in. Demonstrating openness to their input can be advantageous.

- Risk Appetite: Understanding their risk tolerance helps in framing your proposal appropriately. Some family offices might prioritize capital preservation, while others are willing to embrace higher risks for potentially greater returns.

For deeper insights into impact investing and how it aligns with family office motivations, explore The Rise of Impact Investing in Private Equity.

How to Identify the Right Family Offices for Your Startup

Finding the perfect family office requires strategic research and alignment with your startup’s goals.

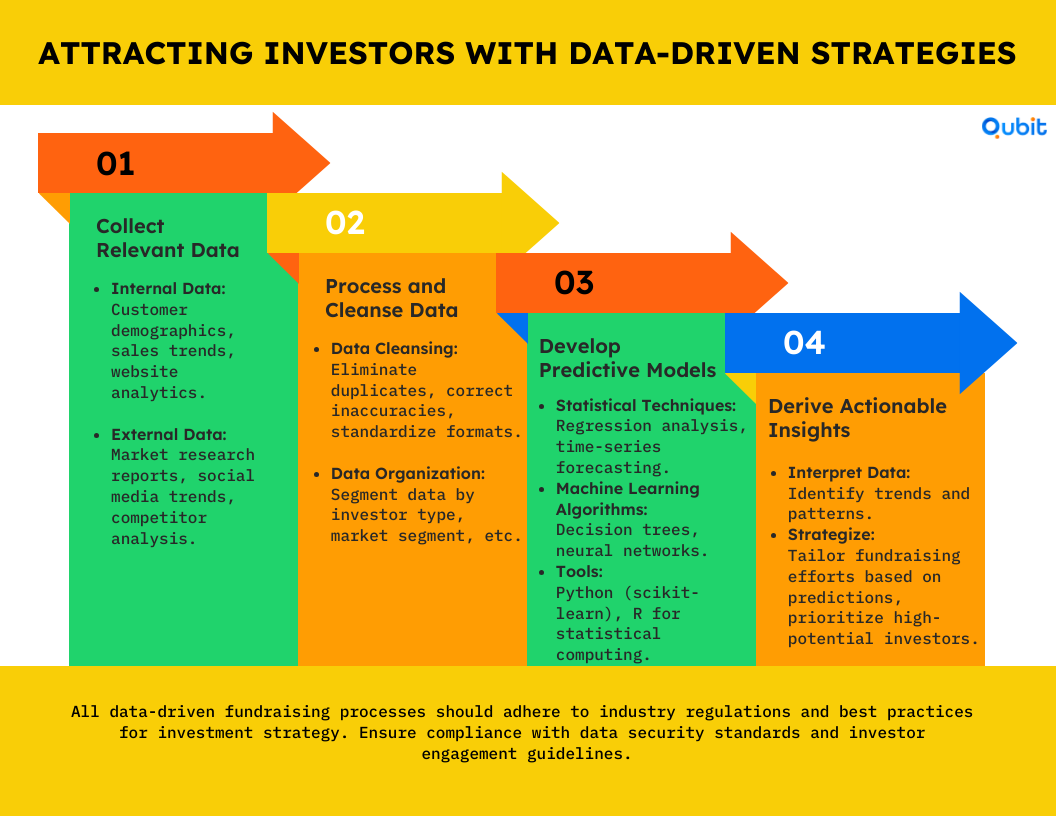

Research Strategies

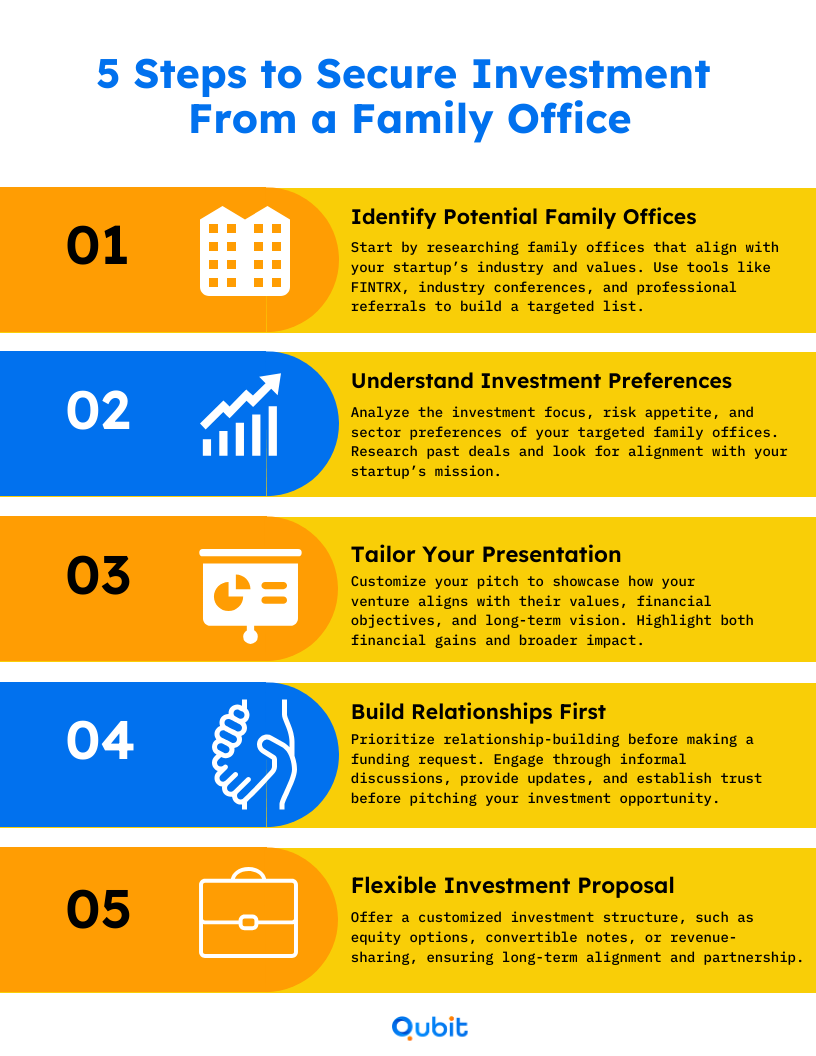

Discovering potential family offices involves:

- Using Specialized Databases: Access databases like Family Office Club or FINTRX, which offer detailed profiles, including investment preferences and contact information.

- Networking at Industry Events: Attend conferences, seminars, and gatherings where family office representatives are present. Personal connections can pave the way for introductions.

- Utilizing Professional Introductions: Engage your network of advisors—lawyers, accountants, and consultants—who may have connections with family offices.

Assessing Alignment

Ensure that the family office aligns with your startup’s vision:

- Match Industry Focus and Values: Research the sectors they invest in and their philanthropic interests. Aligning your startup’s mission with their values increases the chance of a successful partnership.

- Understand Investment Stages and Criteria: Determine whether they invest in startups at your stage of development and comprehend their investment criteria.

- Evaluate Cultural Fit: Consider whether their management style and expectations align with your company’s culture.

Tools to Aid Evaluation

- Family Office Alignment Checklist: Utilize this Family Office Alignment Checklist to systematically assess potential fits. This tool will evaluate critical factors such as investment size, sector focus, and value alignment.

Practical Tips

- Personalize Your Approach: Tailor your communication to reflect an understanding of the family office’s unique perspectives and priorities.

- Prioritize Strategic Value: Focus on family offices that offer not just capital but also strategic benefits, such as industry expertise or valuable networks.

For detailed steps on approaching family offices, see How to Approach Family Offices for Funding. Additionally, consider exploring broader networking strategies in the guide on Effective Networking for Startup Success.

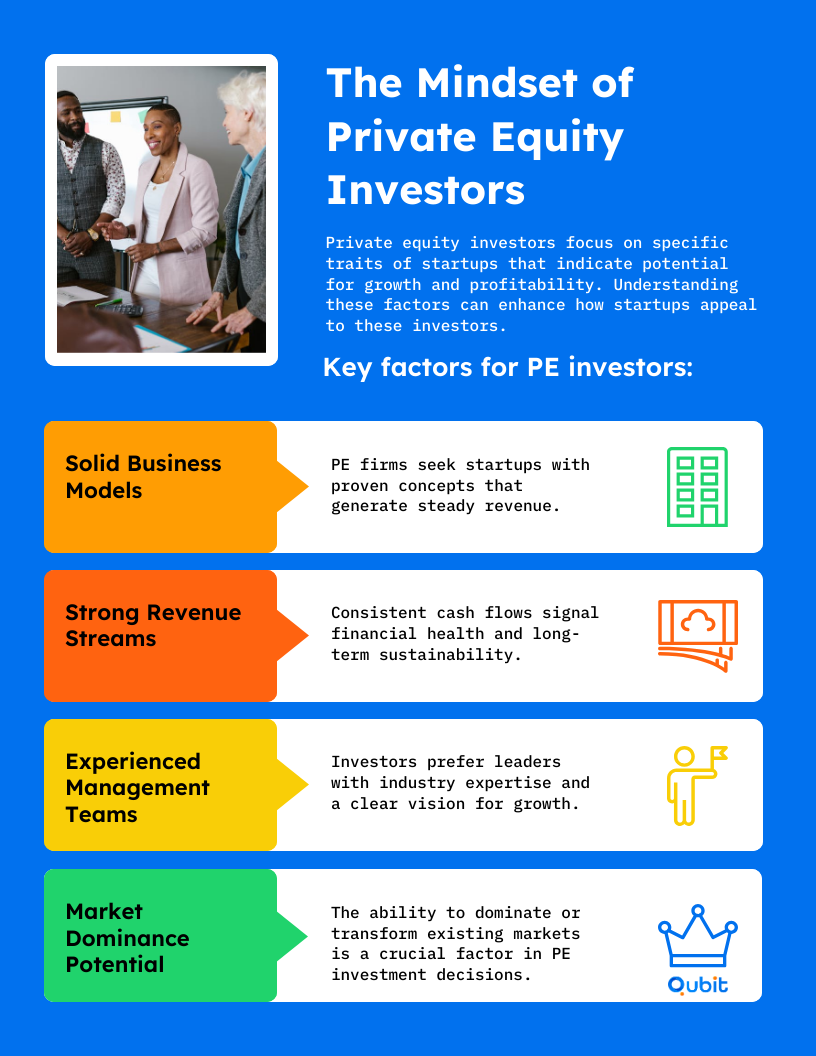

What Are Family Offices Looking For?

To secure funding from family offices, you need to grasp the criteria they prioritize when assessing potential investments.

Common Criteria Considered

Family offices evaluate several key aspects:

- Risk Tolerance: Some are conservative, focusing on wealth preservation, while others embrace higher risks for greater returns. Understanding their risk appetite helps you position your proposal effectively.

- Return Expectations: Clarify whether they seek rapid returns or are patient for long-term growth. Aligning your financial goals is crucial for a successful partnership.

- Sector Preferences: Target your outreach to family offices that have a history of investing in your industry or are keen on entering new sectors.

Approaching the Due Diligence Process

Preparation is fundamental for navigating due diligence:

- Know What to Expect: Family offices conduct thorough evaluations, scrutinizing your business model, financial projections, and team credentials.

- Prepare Essential Documentation: Have detailed financial statements, market analyses, and a compelling pitch deck ready.

- Communicate Transparently: Be upfront about potential risks and challenges. Honesty builds trust and credibility.

Emphasizing ESG Considerations

Environmental, Social, and Governance (ESG) factors have become increasingly important to family office investing:

- Highlight Sustainability Efforts: Demonstrate your commitment to ethical practices and social responsibility. Show how your startup makes a positive impact.

- Provide Impact Metrics: Offer data on how your business contributes to societal or environmental goals.

Gaining Advanced Insights into Decision-Making

Understanding the dynamics of their decision-making could give you a competitive edge:

- Recognize Emotional Factors: Personal relationships and trust significantly influence investment decisions. Building rapport is essential.

- Consider Internal Dynamics: Be aware that multiple family members may be involved in the process, each bringing their perspectives.

For a deeper understanding, read the article on Understanding Family Office Investment Criteria. Additionally, explore strategies for effective communication in The Art of Pitching to Investors.

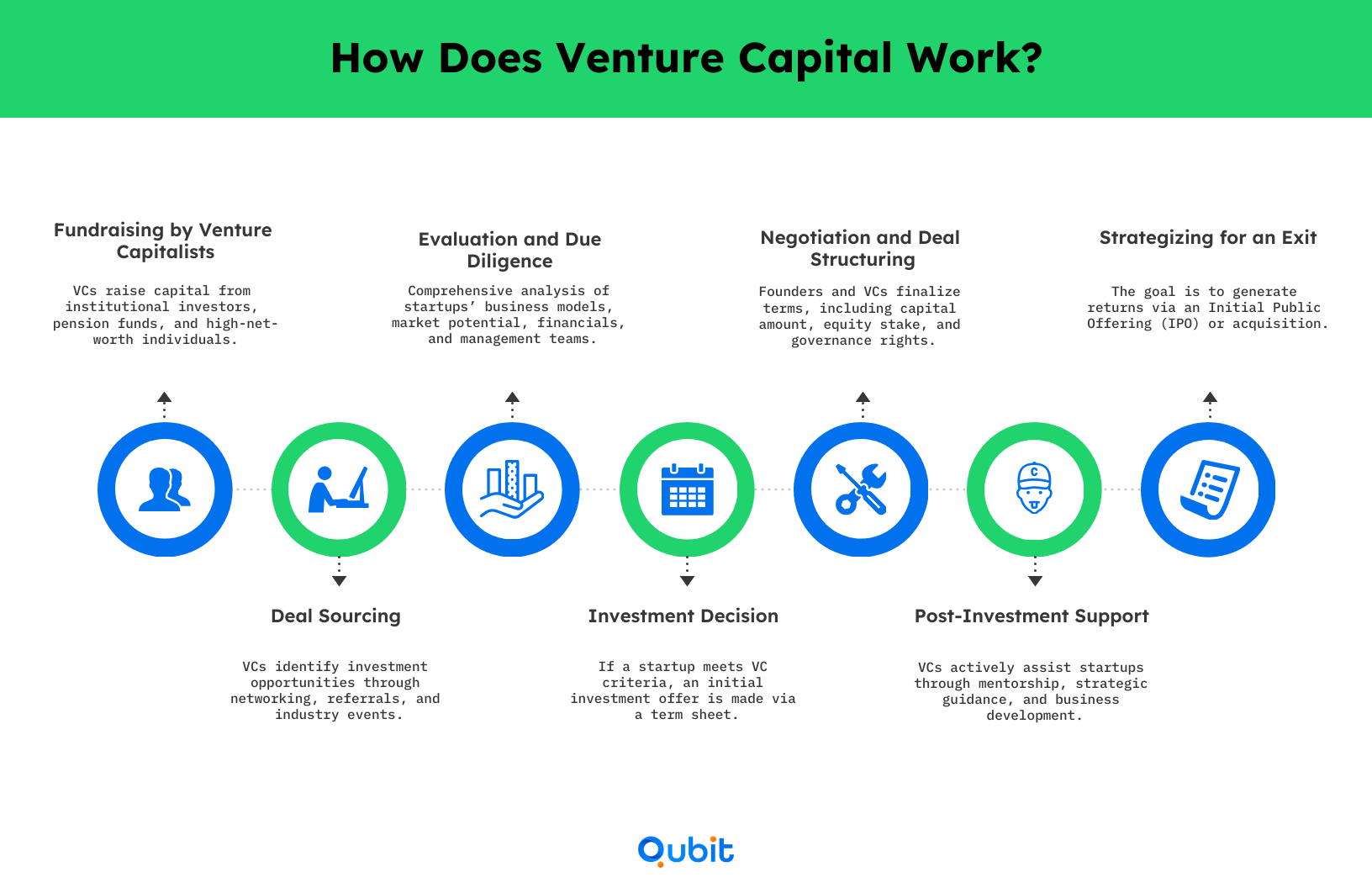

How Family Offices Invest in Startups

Knowing the investment methods of family offices could help you tailor your approach and maximize your chances of securing funding.

Investment Methods Explained

Family offices employ various strategies to invest in startups:

- Direct Investments: Providing capital directly in exchange for equity. This approach allows for a close relationship and potential influence over the company’s direction.

- Co-Investments: Partnering with venture capital firms or other investors to share risks and benefits. Co-investing can enhance deal flow and provide a comprehensive support system.

- Fund Participation: Investing through venture funds or private equity funds, leveraging the expertise of fund managers.

Partnering with Venture Capital Firms

- Benefits of Co-Investing: Combining resources and expertise from both parties can create significant advantages. It can also broaden your support network and increase credibility.

- Considerations: Ensure alignment between all parties to avoid conflicts. Clear communication and agreed-upon terms are essential for a successful partnership.

Flexible Deal Structures

Family offices offer adaptable arrangements to meet your needs:

- Equity Stakes: Traditional shares providing ownership and voting rights.

- Convertible Notes: Loans that convert into equity under predefined conditions.

- Revenue Sharing: Agreements where the investor receives a percentage of future revenue.

Answering Key Questions

How Do Family Offices Invest in Startups?

Family offices invest through tailored approaches that include direct investments or co-investments with venture capital firms. They may also participate in investment funds. Family offices choose methods that align with their strategic objectives and risk tolerance.

Scenarios

- Scenario 1: A family office with a background in agriculture invests directly in an agtech startup, bringing industry expertise and market access.

- Scenario 2: Partnering with a venture capital firm, a family office co-invests in a biotech company, sharing the risks and combining resources for greater impact.

For more examples, read the success stories in Case Studies of Startups Funded by Family Offices.

Personalization Techniques to Impress Family Offices

A personalized pitch greatly improves your chances of securing interest from family offices.

Aligning with Family Values

- Research Their History and Values: Understand the family’s legacy, philanthropic efforts, and previous investments. This knowledge allows you to connect your startup’s mission with their interests.

- Reflect Their Legacy Goals: Demonstrate how partnering with your startup contributes to their long-term objectives and preserves their legacy.

Communicating Positive Impact

- Emphasize Sustainability and Responsibility: Showcase how your business addresses environmental or societal challenges, aligning with their passion for impact investing.

- Highlight Societal Benefits: Provide concrete examples of the positive impact your startup creates, reinforcing your alignment with their values.

Customizing Your Communication

- Personalize Messages: Use language and references that resonate with the family office’s culture and interests. Tailoring your approach shows respect and attention to detail.

- Adjust Presentations: Modify your pitch deck to match their preferred style—whether they value data-driven insights or compelling narratives.

Utilizing Templates and Frameworks

Equip yourself with tools to enhance your pitch:

- Personalized Pitch Template: Access this Personalized Pitch Template to craft a compelling proposal that resonates with family offices.

Success Story

A fintech startup tailored their pitch to align with a family office’s commitment to financial inclusion, emphasizing how their platform increases access to banking services in underserved communities. This personalized approach led to a successful investment.

For additional strategies on effective pitching, explore The Art of Persuasive Communication.

Engaging Family Offices Around the World

Appreciating and navigating cultural differences is fundamental to engaging with family offices internationally.

Recognizing Regional Differences

- Americas: Business interactions tend to be direct, with an emphasis on efficiency. Building rapport quickly is valued.

- Europe: Formality and relationship-building are important. Punctuality and professionalism are expected in interactions.

- Asia: Respect for hierarchy and traditions is paramount. Non-verbal cues and patience play significant roles in communication.

- Middle East: Trust and personal relationships are essential. Hospitality and social engagements often precede business discussions.

Adapting to Cultural Norms

- Research Etiquette: Invest time in understanding local customs and business practices to avoid misunderstandings.

- Language Sensitivity: Be mindful of language barriers. Consider employing professional translation services if necessary.

- Adjust Communication Styles: Adapt your approach to align with cultural preferences, whether that means being more formal or focusing on relationship-building.

Building Trust Across Cultures

- Emphasize Personal Relationships: Show genuine interest in the family office’s culture and values.

- Prioritize Face-to-Face Meetings: Whenever possible, meet in person to establish rapport and demonstrate commitment.

Practical Do’s and Don’ts

- Do:

- Show Respect: Honor cultural norms and express appreciation for their traditions.

- Listen Actively: Pay attention to both verbal and non-verbal communication cues.

- Prepare Thoroughly: Anticipate questions and be ready with informed responses.

- Don’t:

- Stereotype: Treat each family office as unique, regardless of regional generalizations.

- Rush Interactions: Allow time for relationships to develop naturally.

- Be Overly Familiar: Maintain professionalism, especially in formal cultures.

Illustrative Scenarios

- Scenario 1: In Japan, a startup founder ensures to exchange business cards respectfully, using both hands, and takes time to understand the significance of each gesture.

- Scenario 2: In the Middle East, a founder accepts an invitation to a social event, recognizing the importance of personal relationships in business.

For more insights on navigating international business practices, check out Cultural Intelligence in Global Business.

Startups That Secured Family Office Investments

Real examples can provide valuable insights into how other startups successfully engaged family offices.

Case Study 1: Tech Startup and Family Office

Background:

- Startup: A tech company developing AI solutions for the healthcare industry.

- Family Office: Managed by a family with a history in medical philanthropy and investments.

Engagement:

- Connection: The Startup’s founder met the family office representatives at a healthcare conference, initiating a relationship through shared interests.

- Personalization: The pitch highlighted how the startup’s technology aligned with the family office’s commitment to advancing healthcare, emphasizing mutual goals.

Outcome:

- Investment Secured: The Family Office invested $5 million in the Startup’s Series A round.

- Strategic Partnership: The family office provided industry connections and expertise, facilitating growth.

Lesson Learned:

- Aligning with Values: Understanding and reflecting the family office’s legacy goals can lead to successful funding.

Case Study 2: Sustainable Energy Startup and Family Office

Background:

- Startup: Focused on sustainable energy solutions, aiming to revolutionize renewable energy access.

- Family Office: Based in Europe, with a strong emphasis on ESG investments and environmental sustainability.

Engagement:

- Cultural Adaptation: The startup’s team demonstrated respect for European business practices, emphasizing punctuality and professionalism.

- Impact Focus: The pitch underscored how the startup’s solutions contributed to environmental goals, resonating with the family office’s values.

Outcome:

- Long-Term Investment: The family office invested in the startup and facilitated partnerships in the European market, fostering expansion.

Lesson Learned:

- Cultural Sensitivity: Adapting to regional norms and focusing on shared values enhances trust and collaboration.

For more success stories, read the Case Studies of Startups Funded by Family Offices, which shares real-life examples and outcomes.

Strategies to Mitigate Risks with Family Offices

Being proactive in addressing potential obstacles could streamline the investment process with family offices.

Common Challenges

- Misaligned Expectations: Differences in goals or misunderstandings about the partnership can cause friction.

- Communication Barriers: Cultural differences or language challenges may lead to misinterpretation.

- Decision-Making Delays: Family offices might have longer decision cycles due to internal dynamics and comprehensive evaluations.

Strategies for Risk Mitigation

- Set Clear Agreements: Define expectations, roles, and responsibilities upfront. A detailed term sheet can prevent future misunderstandings.

- Maintain Open Communication: Regular updates and transparent dialogue build trust and keep all parties aligned.

- Demonstrate Flexibility: Be prepared to adapt terms to find mutually beneficial solutions. Flexibility can facilitate a smoother negotiation process.

Effective Negotiation Tips

- Seek Win-Win Outcomes: Focus on creating value for both parties rather than adopting a competitive stance.

- Prepare Thoroughly: Understand your non-negotiable points and areas where you’re willing to compromise.

- Listen Actively: Pay attention to the family office’s concerns and address them thoughtfully.

Examples of Overcoming Obstacles

- Addressing Misaligned Expectations: A startup clarified their growth trajectory and risk profile early on, ensuring alignment with the family office’s objectives.

- Overcoming Communication Barriers: Engaging a cultural liaison helped bridge language gaps and facilitated clearer understanding.

Building Strong Relationships with Family Offices

Developing a lasting partnership with a family office requires ongoing effort and commitment.

The Importance of Trust

- Establish Credibility: Consistent performance and reliability are essential for building trust.

- Be Transparent: Honesty about successes and challenges fosters a genuine relationship.

Maintaining Open Communication

- Regular Updates: Keep the family office informed about progress, milestones, and any issues that arise.

- Solicit Feedback: Encourage open dialogue and be receptive to their insights and advice.

Viewing Them as Partners

- Involve Them Strategically: Consider their expertise and involve them in strategic discussions where appropriate.

- Align on Vision: Ensure that both parties share common long-term goals and values.

For comprehensive tips, see Building Strong Relationships with Family Offices. You’ll get a deeper insight into the strategies for cultivating successful partnerships.

Conclusion

Securing funding from family offices can be transformative for your startup. Understand their motivations and align with their values. Also, pay attention to cultural nuances and you’ll position your company for a successful partnership.

We encourage you to apply these strategies proactively to secure funding from family offices.

Take the Next Step:

Discover how Qubit Capital can assist you in connecting with family offices and navigating the investment process. Discover opportunities with Qubit Capital’s expert guidance.

For a broader understanding of financing options, check out our Comprehensive Guide to Startup Funding Sources. It offers tips for various strategies to fuel your company’s growth.

Key Takeaways:

- Family Offices Offer More Than Capital: They provide long-term support, strategic partnerships, and valuable networks to accelerate your startup’s growth.

- Personalization is Critical: Tailoring your pitch to align with a family office’s values and legacy goals significantly enhances your chances of securing investment.

- Understanding Cultural Nuances Matters: Adapting to regional differences in business practices builds trust and fosters stronger relationships with family offices worldwide.

- Building Long-Term Relationships: Viewing family offices as partners rather than just investors leads to more fruitful collaborations and sustained success.

- Preparation is Essential: Thorough research into a family office’s investment criteria and decision-making processes positions you to meet their expectations effectively.

Frequently Asked Questions (FAQ)

What is a Family Office in Investing?

A family office in investing is a private company that manages investments and wealth for a single affluent family. They handle investment management, estate planning, tax services, philanthropy, and more. Family offices can range from small teams to large organizations, depending on the family’s needs and wealth.

- Internal Link: Learn more in What Are Family Offices.

How Do Family Offices Invest in Startups?

Family offices invest in startups through:

- Direct Investments: Providing capital directly to startups.

- Co-Investments: Partnering with venture capital firms or other investors.

- Participating in Funds: Investing through venture funds or private equity vehicles.

What Are the Benefits of Family Offices Investing in Startups?

- Long-Term Commitment

- Flexible Capital Structures

- Strategic Support and Networks

- Interest in Impact and Sustainability

What Are Some Examples of Family Offices Investing in Startups?

Refer to our success stories in Case Studies of Startups Funded by Family Offices, where we share real-life examples and outcomes.

The strategies outlined in this guide are your answer to successfully engage with family offices. Remember, the key lies in understanding their motivations, personalizing your approach, and building strong relationships that last.

Back

Back