Understanding your audience is the cornerstone of effective investor outreach. When businesses align their strategies with market segmentation theories, they unlock the potential to identify investors who truly resonate with their goals. This approach goes beyond traditional methods, offering a refined way to categorize investors based on compatibility and shared vision.

By understanding how to find investors for startups, businesses can lay the groundwork for creating a targeted segmentation strategy. This ensures resources are directed toward individuals or groups most likely to engage, fostering meaningful connections.

In this blog, we’ll explore how advanced segmentation techniques can revolutionize investor targeting, helping businesses focus on the right audience for maximum impact.

Pitfalls of Traditional Investor Segmentation

Relying on traditional market segmentation theories often leads to missed opportunities and misaligned strategies. Conventional methods, such as demographic, geographic, or psychographic segmentation, focus on surface-level traits while failing to capture the deeper motivations driving investor behavior. This oversimplification can result in outreach efforts that fall flat, as they fail to resonate with the true priorities of the target audience.

The Problem with Superficial Categorization

Traditional segmentation methods group investors based on broad characteristics, such as age, income, or location. While these metrics provide a starting point, they often overlook the complexity of individual decision-making processes, lacking targeted strategy. For instance, two individuals with similar demographic profiles may have vastly different investment goals, risk tolerances, and values. This lack of nuance can lead to poorly tailored messaging and missed connections.

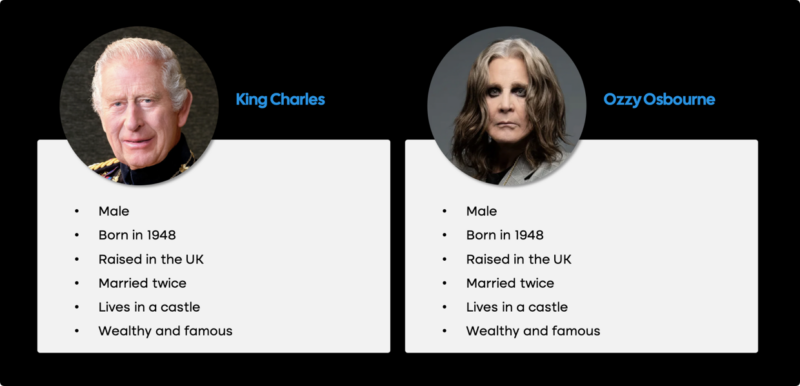

An interesting example: King Charles vs. Ozzy Osbourne

To illustrate the pitfalls of traditional segmentation, consider the example of King Charles and Ozzy Osbourne. Both are British men of a similar age, yet their lifestyles, values, and likely investment preferences could not be more different. Relying solely on demographic data would group them together, ignoring the stark contrasts in their priorities and financial goals. This case study highlights why nuanced segmentation is essential for identifying investors who truly align with a fund’s profile. For a visual representation of this comparison, refer to this example, which can also be used in presentations or training modules.

Moving Beyond Traditional Approaches

Oversimplified segmentation frameworks often result in generic strategies that fail to engage investors on a meaningful level. To address this, fund managers and financial professionals must adopt more dynamic methods that delve deeper into investor psychology and behavior. Understanding how to build an investor map can be a game-changer in this context. By creating a roadmap that prioritizes nuanced insights over basic categorizations, organizations can craft strategies that align more closely with investor motivations. Learn more about this approach

Advanced Segmentation with the MEHRHOFF Framework

Investor segmentation has evolved far beyond traditional demographics, and the MEHRHOFF Framework exemplifies this shift. By incorporating seven distinct pillars—Market Trends, Emotional Drivers, Habitual Patterns, Life-Moments, Objectives and Goals, Financial Constraints, and Heuristics and Biases—this advanced approach provides a deeper understanding of investor behavior. Unlike conventional segmentation theory, which often relies on static data, the MEHRHOFF Framework dynamically aligns with the nuanced motivations and decision-making processes of investors.

Breaking Down the Seven Pillars

Each pillar of the MEHRHOFF Framework contributes uniquely to investor segmentation, offering actionable insights for tailored outreach strategies.

- Market Trends

Understanding how investors respond to shifts in market conditions is critical. This pillar focuses on identifying patterns in investor behavior during market fluctuations, such as bullish or bearish trends. By analyzing these responses, businesses can predict investment preferences and align their communication strategies accordingly. - Emotional Drivers

Emotional factors often influence financial decisions more than logic. Whether it’s fear during market downturns or optimism during growth phases, this pillar examines the emotional triggers that guide investor actions. Recognizing these drivers enables businesses to craft messages that resonate on a personal level. - Habitual Patterns

Investors often develop habits based on past experiences. This pillar delves into recurring behaviors, such as preferred investment vehicles or risk tolerance levels. By identifying these patterns, businesses can anticipate investor needs and offer solutions that align with their established preferences. - Life-Moments

Major life events, such as retirement or career changes, significantly impact investment decisions. This pillar emphasizes the importance of timing and context in investor outreach. For instance, targeting individuals nearing retirement with tailored financial planning solutions can yield higher engagement rates. - Objectives and Goals

Every investor has unique financial objectives, whether it’s wealth accumulation, retirement planning, or legacy building. This pillar focuses on aligning outreach strategies with these goals, ensuring that communication is both relevant and impactful. - Financial Constraints

Understanding an investor’s financial limitations is essential for effective segmentation. This pillar examines factors such as income levels, debt obligations, and liquidity needs to ensure that proposed investment opportunities are realistic and attainable. - Heuristics and Biases

Cognitive biases, such as overconfidence or loss aversion, play a significant role in investment decisions. This pillar explores how these psychological factors influence behavior, enabling businesses to address potential barriers to engagement.

Practical Applications of the MEHRHOFF Framework

The MEHRHOFF Framework has already demonstrated its value in real-world scenarios. For example, startups seeking to identify and segment potential investors can benefit from tools that incorporate these pillars. Using the best investor discovery tools ensures that businesses can efficiently pinpoint investors whose motivations align with their offerings.

Additionally, the framework has been instrumental in developing targeted strategies for investor outreach. By integrating insights from all seven pillars, businesses can craft personalized communication that not only captures attention but also builds trust and fosters long-term relationships.

Why the MEHRHOFF Framework Stands Out

Unlike traditional approaches, which often segment investors based on surface-level attributes, the MEHRHOFF Framework dives deeper into the psychological and contextual factors that drive decision-making. This comprehensive approach ensures that businesses can connect with investors on a meaningful level, ultimately leading to more successful outcomes.

Future Trends and Customizing Investor Outreach

Investor segmentation is evolving rapidly, driven by advancements in technology and shifting priorities among investors. Emerging trends, such as AI-driven analytics and the growing emphasis on sustainable investing, are reshaping how businesses categorize and approach potential investors. These methods enable more precise segmentation, helping organizations identify investors whose interests align with their goals.

Key Criteria for Effective Segmentation

Successful segmentation hinges on understanding critical factors such as industry focus, geographic preferences, and investment stage. Tools like Foundercrate CRM simplify this process by automatically categorizing investors based on these parameters. Integrating Foundercrate CRM into your investor relations process ensures that outreach efforts are both efficient and targeted.

Practical Strategies for Tailored Communication

- AI-Driven Insights: Harness AI analytics to analyze investor behavior and preferences. This approach provides actionable insights, enabling businesses to craft personalized communication strategies.

- Sustainability Focus: Address the increasing demand for sustainable investing by highlighting projects that align with environmental, social, and governance (ESG) principles.

- Data Maintenance: A well-maintained investor database can significantly enhance segmentation accuracy.

Benefits of Personalization

Tailored outreach enhances engagement, builds trust, and improves funding success rates. By customizing communication based on detailed segmentation, businesses can foster stronger relationships with investors, ensuring mutual value and long-term collaboration.

Innovative Investor Profiling Techniques

Defining Unique Behavioral Patterns

Beyond basic categorization, firms may benefit from learning investor mapping techniques for startups based on identifying subtle behavioral traits that reveal true investment propensities. By monitoring investor actions over time, organizations gain an enriched view of decision-making processes. This refined method encourages teams to question assumptions and examine details that conventional approaches might overlook.

Capturing Unspoken Preferences

Observations extend past evident criteria, uncovering inclinations that investors may not readily express. Through qualitative assessments and dialogue analysis, stakeholders can discern patterns that drive financial commitments. These insights provide a fresh perspective on grouping investors beyond surface-level demographics. Additionally, combining varied data sources contributes to an evolving profile that adjusts as market sentiments shift. Emphasizing this nuanced exploration, companies can build a robust profile that reveals concealed alignments between investor values and funding opportunities.

In summary, adopting innovative profiling techniques promotes clarity in targeting and improves communication outcomes. A commitment to continuous refinement of behavioral insights ultimately results in more accurate segmentation and lasting investor relationships.

Consolidating insights from varied perspectives creates a comprehensive blueprint that informs investment outreach strategies. Methodical analysis coupled with creative refinement generates approaches that are systematic and inventive, ensuring investor profiles remain precise and influential.

Enhancing Investor Communication Strategies

Custom Outreach Programs

Developing tailored communication plans requires attentive listening and careful segmentation. Investment firms can design initiatives that incorporate direct feedback and continuous monitoring. By formulating programs that address investor concerns in practical terms, organizations reinforce credibility and invite greater collaboration. Detailed planning combined with periodic reassessment refines communication channels, ensuring that messaging remains relevant to evolving investor perspectives.

Adaptive Data Insights

Incorporating fresh data streams into communication strategies yields a dynamic approach. Key factors to consider include:

- Transaction history and investment milestones.

- Personal achievements that may influence future funding decisions.

- Shifts in market sentiment and individual responses to economic trends.

These elements inform targeted messaging that connects with investors on a personal level. Strategic use of diverse data types encourages a more flexible communication process, one that responds to real-time feedback without compromising clarity. A robust program will integrate qualitative assessments and quantitative analyses, enhancing the overall understanding of investor behavior.

Altogether, a structured communication plan that combines custom outreach with adaptive insights paves the way for more meaningful engagements. This integrated approach enables investment firms to maintain fluid interactions that resonate with investor priorities, ultimately fostering deeper relationships and long-term commitment, consistently indeed.

Conclusion

Effective investor segmentation is the cornerstone of successful funding strategies. By moving beyond traditional methods and embracing advanced frameworks like the MEHRHOFF Framework’s seven pillars, startups can unlock higher-quality engagements and improved open rates. Tailored communication methods, combined with nuanced segmentation, not only enhance investor relationships but also pave the way for more successful funding rounds.

If you're ready to refine your investor segmentation strategy, we at Qubit Capital can guide you. Check out our Investor Discovery and Mapping service to ensure you connect with the right investors.

FAQ Section

What are the 4 main ways to segment a market?

Market segmentation can be broken down into these four primary categories:

- Demographic Segmentation: Focuses on characteristics like age, gender, income, education, and occupation. For example, a luxury car brand might target high-income professionals.

- Geographic Segmentation: Divides the market based on location, such as country, city, or climate. A winter clothing brand may prioritize colder regions.

- Psychographic Segmentation: Considers lifestyle, values, and interests. For instance, eco-friendly products often appeal to environmentally conscious consumers.

- Behavioral Segmentation: Analyzes purchasing behavior, brand loyalty, or product usage. A streaming service might target frequent binge-watchers with tailored subscription plans.

What is an investment segment?

An investment segment refers to a specific category or group within a portfolio that shares common characteristics, such as asset type, risk level, or investment objective. For example, a portfolio might include segments for equities, bonds, and real estate, each catering to different financial goals and risk tolerances.

How do you segment a portfolio?

To segment a portfolio effectively, follow these steps:

- Identify Investment Goals: Define objectives like growth, income, or preservation.

- Assess Risk Tolerance: Determine the acceptable level of risk for each segment.

- Categorize Assets: Group investments by type, such as stocks, bonds, or alternative assets.

- Allocate Proportions: Assign a percentage of the portfolio to each segment based on goals and risk.

- Monitor and Adjust: Regularly review performance and rebalance as needed.

How to do a market segment?

Market segmentation involves dividing a broad audience into smaller, more manageable groups based on shared traits. Start by analyzing data to identify patterns, then categorize customers using criteria like demographics, geography, or behavior. This approach ensures targeted marketing efforts and improved customer engagement.

Key Takeaways

- Traditional segmentation methods often fall short by relying on superficial categorizations.

- A deep, nuanced approach using the MEHRHOFF Framework can better capture investor motivations.

- Real-world case studies, like King Charles vs. Ozzy Osbourne, highlight the risks of oversimplified segmentation.

- Emerging trends and tools such as Foundercrate CRM are essential for tailoring investor outreach.

- Integrating these advanced strategies leads to improved engagement and more successful funding outcomes.

Back

Back