Adapting to feedback is a cornerstone of investor relations best practice, especially in dynamic markets. Feedback not only highlights areas for improvement but also reveals opportunities to refine your approach. For startups, understanding how to find investors for startups creates a solid foundation for developing adaptable strategies that align with evolving investor expectations. This process ensures that your pitch and communication strategies remain relevant and impactful.

In this blog, we’ll explore how to harness both qualitative insights and quantitative metrics to refine your investor outreach. From actionable strategies to expert insights, you’ll gain practical tools to stay agile and responsive. Let’s dive into how feedback can transform your approach and drive better outcomes.

Master Investor Feedback to Unlock Strategic Value

Investor feedback plays a transformative role in shaping business strategies, particularly during critical phases like capital raising or strategic pivots. By tapping into the seasoned experience and extensive networks of investors, businesses gain access to insights that can redefine their trajectory. These insights, whether qualitative or quantitative, serve as a compass for making informed decisions that align with market demands and growth opportunities.

For example, Seth Godin’s article, "Beware of Experience Asymmetry", highlights the importance of bridging the gap between founders and seasoned professionals. It underscores how external expertise can guide startups through uncharted challenges, ensuring strategies remain agile and effective.

Understanding investor mapping fundamentals is equally crucial. It allows startups to refine their approach based on data-driven insights and feedback loops, ensuring that diverse perspectives drive pivotal decisions.

Why Investor Feedback is Critical

Investor communication plays a pivotal role in shaping a startup’s trajectory. Feedback from investors not only refines pitches but also provides valuable insights that can influence business strategies. Founders must critically evaluate investor perspectives to ensure decisions are well-informed and aligned with their core objectives.

External insights often reveal opportunities or challenges that founders might overlook. For example, exploring the local vs global investors pros cons helps startups tailor their strategies to geographic considerations revealed through feedback. This alignment ensures that feedback serves as a tool for growth rather than a distraction.

Integrating trust-building tactics into feedback loops can further enhance responsiveness and agility.

5 Strategic Ways to Collect Investor Feedback

Gathering investor feedback is essential for refining strategies and strengthening investor relations. Below are five actionable methods to ensure every interaction provides valuable insights:

- One-on-One Meetings

Personalized discussions create an environment for candid feedback. These sessions allow investors to share their perspectives openly, fostering trust and uncovering specific concerns or suggestions. - Pitch Events

Presenting at pitch events offers a unique opportunity to gain external perspectives. Feedback from a diverse audience can highlight areas for improvement and validate your approach. - Regular Updates

Consistent communication through an investor update newsletter ensures ongoing dialogue. Use these updates to share progress and invite feedback, keeping investors engaged and informed. - Board Meetings

These structured sessions provide in-depth strategic insights. Board members often have a wealth of experience, making their feedback invaluable for long-term planning. - Informal Channels

Casual emails or phone calls can capture immediate feedback. These informal interactions often reveal insights that might not surface in formal settings.

Feedback from these methods can also clarify how to prioritize investors for maximum impact.

Streamlining Investor Connectivity with Digital Tools

Digital tools have revolutionized investor relations best practice by simplifying and centralizing communication. Platforms like Qubit Capital enable businesses to collect real-time investor feedback, fostering agile strategy adjustments. This capability ensures that companies can align their investor relations objectives and goals with evolving market demands.

Case studies, such as Airtree Venture's Transformation with Visible, highlight measurable improvements in engagement. Airtree's experience demonstrates how actionable feedback from investors can drive significant business evolution.

Additionally, insights from High Alpha's 2024 SaaS Benchmarks reveal trends like evolving pricing models and market stabilization, which can inform dynamic communication strategies.

Embracing technology not only streamlines communication but also empowers companies to adapt swiftly to investor needs.

Effective Follow-Up Practices After Pitch Presentations

You may have mastered strategic investor mapping, but maintaining momentum after a pitch presentation is crucial for fostering strong investor relations. Timely follow-ups are an investor relations best practice that ensures enthusiasm remains high and communication channels stay open. Investors appreciate personalized updates that reflect the value placed on their feedback, making tailored communication a vital component of post-pitch engagement.

Adaptability also plays a key role in follow-up strategies. By responding to investor preferences and adjusting communication styles accordingly, businesses have historically achieved better outcomes. Whether through direct emails, calls, or an investor update newsletter, the goal is to keep the dialogue active and meaningful.

A well-crafted follow-up not only demonstrates professionalism but also sets the stage for future collaboration, ensuring investors remain engaged and confident in the partnership.

Crafting Personalized Thank-You Emails for Investor Engagement

A well-crafted thank-you email can leave a lasting impression on investors. Personalization is key to making these emails stand out. Referencing specific details from your pitch, such as a unique statistic or a shared vision, demonstrates attentiveness and builds credibility. For instance, mentioning how an investor's feedback influenced your strategy shows genuine engagement.

These thoughtful touches create a human connection, fostering trust and rapport. Additionally, personalized follow-ups align with broader investor relations objectives and goals, strengthening long-term relationships. A tailored email not only acknowledges their time but also reinforces your commitment to collaboration.

Maintaining Investor Communication without Overwhelming Them

Effective investors communication requires a thoughtful balance between keeping stakeholders informed and respecting their time. Bombarding investors with excessive updates can dilute the impact of your messages and lead to disengagement.

Instead, focus on delivering regular updates that provide meaningful insights. For instance, an investor update newsletter can serve as a structured channel for sharing key milestones, financial performance, and strategic developments. This approach ensures that updates are both consistent and relevant.

Additionally, prioritize quality over quantity. A concise, well-crafted message that addresses investor reporting meaningfully will resonate more than frequent, generic updates. By maintaining a rhythm of communication that emphasizes value, you can foster trust and preserve goodwill, ensuring your investors remain engaged without feeling overwhelmed.

Enhancing Your Pitch with Investor Feedback

Refining your investor presentation is an ongoing process, and feedback plays a pivotal role in achieving success. Startups that actively seek and implement feedback experience a 30% higher funding success rate. This underscores the importance of tailoring your pitch to align with investor expectations. By utilizing tools to monitor the Feedback Rate, you can identify areas for improvement and make data-driven adjustments that resonate with your audience.

Adapting your pitch based on feedback doesn’t just improve your chances of funding—it also boosts engagement. Over 40% of startups that revised their presentations after investor meetings reported significant engagement improvement. For example, Airbnb transformed its pitch strategy by integrating specific investor feedback. This led to clearer messaging and ultimately secured the funding they needed to scale.

To avoid common pitfalls, such as misalignment with investor expectations (a factor contributing to 17% of startup failures, according to CB Insights), consider adopting agile practices. Continuously revising your pitch ensures it remains relevant and impactful. Embracing feedback as a core part of your strategy is one of the most effective investor presentation best practices to secure funding and build lasting investor relations.

Building an Effective CRM Strategy for Investor Relations

A well-designed CRM strategy can transform how businesses manage investor relations. By centralizing investor data, CRM systems ensure efficient tracking and organization of interactions. Tools like HubSpot automate follow-ups, schedule meetings, and monitor communication, allowing teams to focus on strategic investor relations objectives and goals. For example, integrating HubSpot CRM into your investor update workflow can automatically send surveys after pitches, streamlining feedback collection.

Automation not only simplifies follow-ups but also consolidates valuable data, offering insights that drive informed decision-making. This approach enhances communication with investors, ensuring timely updates and fostering trust. Ultimately, an effective CRM strategy strengthens relationships, aligning with investor relations best practices to support long-term growth.

The Importance of Regular Business Updates to Investors

Keeping investors informed through consistent communication is a cornerstone of building trust. A well-structured investor update newsletter not only demonstrates transparency but also reinforces confidence in your business’s strategic direction. Regular updates allow investors to track progress, evaluate milestones, and align their expectations with your company’s vision.

To maintain strong relationships, focus on clarity and frequency. Share key metrics, upcoming goals, and any challenges faced. Transparency in these areas establishes credibility and fosters long-term partnerships. Additionally, adhering to an investor relations best practice guide ensures your updates remain professional and relevant.

Investors value consistent reporting as a critical factor in decision-making. By prioritizing open communication, businesses can create a foundation of trust that supports sustained growth and mutual success.

Responding Effectively to Investor Questions Post-Pitch

A well-prepared response to investor questions can make or break the momentum of your pitch. To ensure success, focus on crafting clear, data-backed answers that directly address the concerns raised. This approach not only demonstrates your expertise but also builds trust, a cornerstone of effective investor relations objectives and goals.

For example, Dropbox showcased investor presentation best practices by preparing adaptable presentation templates to address specific inquiries. Their detailed follow-up materials highlighted their readiness and commitment, leaving a lasting impression on potential investors.

Transparency is equally critical. If an investor raises a challenging question, acknowledge it openly and provide a thoughtful response. This level of honesty can transform skepticism into confidence, potentially securing further investment.

Fostering Long-Term Investor Relationships

Establishing enduring investor relationships is a cornerstone of investor relations best practice. Transparent communication and consistent updates are essential in building trust that stands the test of time. Investors value clarity, and providing them with regular, detailed insights into company performance fosters confidence in your leadership.

To align with investor relations objectives and goals, maintaining open channels of communication is critical. This includes sharing both successes and challenges, ensuring investors feel like true partners in the journey. Such transparency not only strengthens trust but also encourages sustained support during market fluctuations.

Consistency in messaging further enhances credibility. By delivering updates on a predictable schedule, companies demonstrate reliability, which is crucial for long-term investor engagement. A proactive approach to investors communication solidifies these relationships, creating a foundation for mutual growth and success.

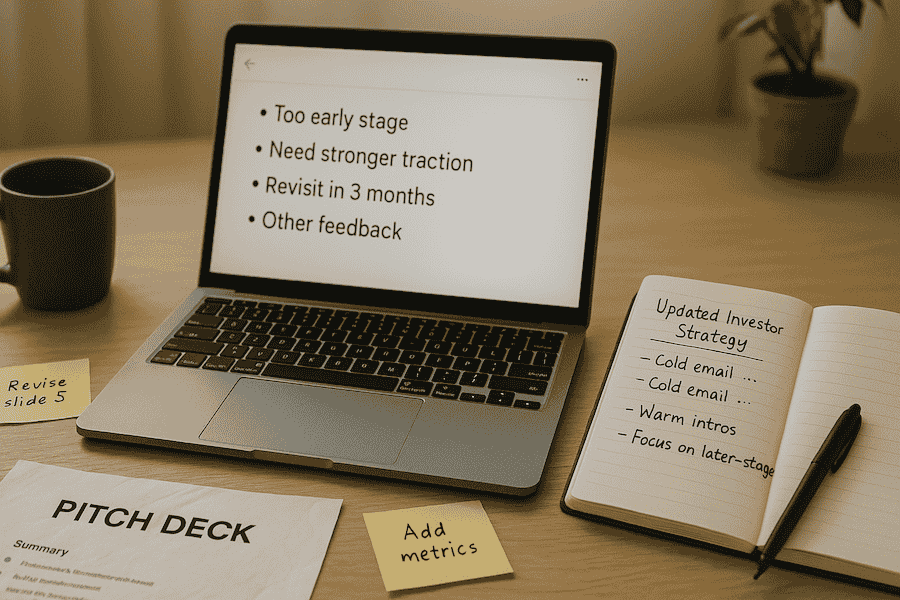

Learning and Growing from Investor Rejections

Every rejection from an investor carries valuable lessons that can shape future success. While it may initially feel like a setback, constructive feedback from declined offers often reveals areas for improvement. This insight is crucial for refining your approach and aligning your strategies with investor expectations.

Embracing rejection as a learning opportunity transforms challenges into growth moments. For example, feedback on your investor presentation best practices might highlight gaps in clarity or alignment with market trends. By addressing these gaps, you can craft more compelling pitches that resonate with potential investors.

Rejection is not the end—it’s a stepping stone toward better outcomes. Treat each declined offer as a chance to enhance your investor relations best practice, ensuring your next pitch is stronger and more strategic.

Core Principles for Effective Investor Interaction

Engaging effectively with investors requires a thoughtful approach grounded in communication and collaboration. Active listening is the cornerstone of investor relations best practice, ensuring feedback is accurately received and understood. By attentively focusing on what investors share, businesses can uncover valuable insights that might otherwise be overlooked.

Thoughtful reflection transforms feedback into actionable improvements. Taking time to evaluate investor input helps identify areas for growth and refine strategies. Seeking clarity is equally essential; asking questions to confirm understanding prevents miscommunication and strengthens trust.

Collaboration drives innovative solutions. Working alongside investors to address challenges fosters a shared sense of purpose and often leads to creative outcomes. Applying data analytics for investor mapping enables startups to make informed decisions and adjust their strategies based on feedback loops.

Conclusion

Adapting investor feedback into your pitch and business strategies is a dynamic process that requires precision and transparency. By actively listening to insights from investors, startups can refine their presentations and align their goals with market expectations. This approach not only enhances the pitch but also fosters trust and credibility.

The importance of agile refinement cannot be overstated. Incorporating feedback-driven improvements ensures your pitch remains relevant and compelling, while transparent communication strengthens relationships with potential investors. Throughout this blog, we’ve emphasized the value of combining expert perspectives, actionable data, and practical tools to create a robust strategy for investor engagement.

If you're ready to elevate your investor engagement, our Investor Outreach service can connect you with the right opportunities. Contact us today to take the next step in building meaningful investor relationships.

FAQ Section

How to do investor updates?

Investor updates should be concise and focused. Start by drafting clear summaries that highlight key milestones, financial metrics, and any significant developments. Regular communication, such as structured newsletters, ensures consistency. Always include recent achievements and outline actionable plans for addressing challenges.

What is an IR strategy?

An IR strategy refers to a structured approach for engaging with investors. It aligns your business objectives with investor expectations by maintaining transparency, providing regular updates, and fostering open feedback channels.

How to ask investors for feedback?

Requesting feedback from investors requires a thoughtful approach. Begin by preparing specific, targeted questions. Engage in one-on-one discussions to encourage open dialogue, and follow up with surveys or emails for additional insights. Use the feedback to refine your strategy and improve your pitch.

What makes good investor relations?

Strong investor relations hinge on clear, data-driven communication. Regular updates, responsiveness, and transparency are essential. Incorporating real-life metrics and case studies further builds trust and demonstrates accountability.

Key Takeaways

- Investor feedback is a critical driver for refining business strategy.

- Active listening and clear communication form the foundation of effective investor relations.

- Collecting multi-channel feedback—from meetings to digital updates—provides actionable insights.

- Data-driven pitch adjustments can significantly boost funding success.

- A well-integrated CRM and scheduling system streamline investor follow-ups and relationship building.

Back

Back